simplyELSTERplus

A new approach to tax returns

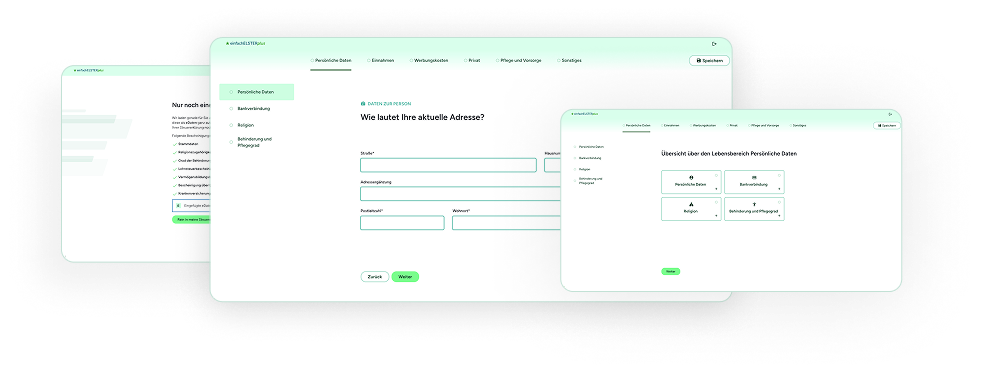

The simplyELSTERplus application shows new ways of filing digital tax returns. As part of the ELSTER family, simplyELSTERplus focuses on maximum user-friendliness, intuitive operation and a completely new user experience: no complicated forms, but a clear, guided process that leads you through the tax return step by step.

simplyELSTERplus was developed for people who do not want to deal with tax issues on a daily basis, but want to reach their goal easily, quickly and safely. simplyELSTERplus recognizes what is really important and helps to declare everything correctly and completely through automatic checks.

simplyELSTERplus is suitable for people who live in Germany, have an ELSTER user account, are employees, do not wish to declare details of children and want to complete their tax return on their own.

Try it out now!

Why einfachELSTERplus?

- Intuitive user guidance

Clear steps instead of complicated forms. You are guided through the explanation in a logical and understandable way. - Modern look & feel

Reduced design, clear and uncluttered - no comparison with conventional control platforms. - Only what really counts

The application only shows the fields that are relevant to you - perfect for employees without complicated tax cases. - Reach your goal quickly and securely

Data is automatically checked and sent directly to the tax office. Secure, correct and complete.

What einfachELSTERplus can do

einfachELSTERplus is designed for citizens who have a simple tax case and want to complete their own tax return quickly and easily. The application can currently be used to submit tax returns for the years 2023 and 2024. You can easily find out whether einfachELSTERplus suits your tax case here check.

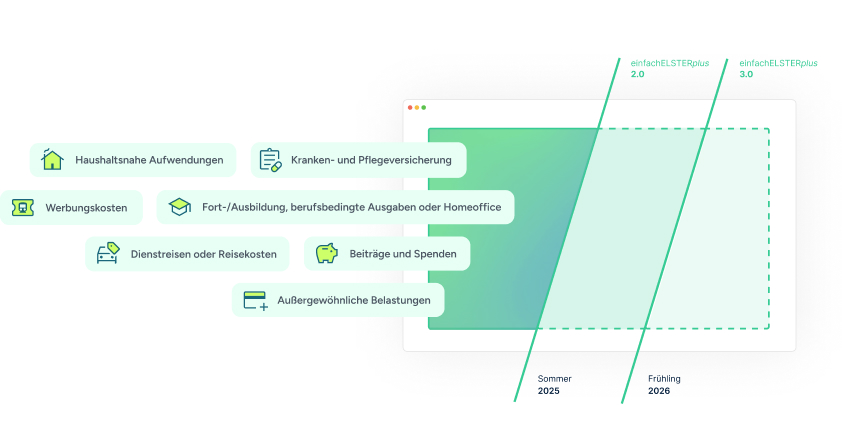

The scope of the declaration is constantly being developed

einfachELSTERplus is currently under development and will be continuously expanded to cover even more life situations and requirements in the future. The matters currently supported include, for example

It's even easier with eData

Have you already agreed to the retrieval of your electronic tax data (eData)? Perfect! einfachELSTERplus automatically takes available information - for example from income tax certificates or insurance policies - and enters it directly into your return. This saves you time and avoids typing errors. And if you prefer to enter your details yourself: The guided interview mode supports you step by step - simple, easy to understand and reduced to the essentials.

Stay flexible - switch to Mein ELSTER seamlessly and without losing data

With einfachELSTERplus , you can start your tax return quickly and easily. If your personal case cannot yet be fully mapped, you have the option of switching directly to Mein ELSTER at the end without losing any data. All the information you have already entered is automatically transferred - you simply continue with your return and add the missing details. This means you remain flexible and don't have to enter anything twice.

How einfachELSTERplus works

Further information

In this video, we show you how to use einfachELSTERplus to prepare your tax return step by step in a simple, understandable and secure way:

Has einfachELSTERplus aroused your interest?

einfachELSTERplus is proof that tax returns don't have to be complicated. Try it out - and experience how simple tax really can be.

Try it out now!